Adverse financial background screening made easy.

Bankruptcy and insolvency checks - get the full picture

A bankruptcy check helps you know your candidate and gain valuable insight into how they manage finances.

There are certain roles where adverse financial background screening is vital. Bankruptcy checks are important for all industries, however, they are most important for businesses in highly regulated sectors that require significant levels of financial and operational compliance.

These checks can show that when it comes to handling money and making financial decisions, the candidate has demonstrated responsibility and stability in the past. This gives employers confidence that the individual has the right skills and experience to carry out the role.

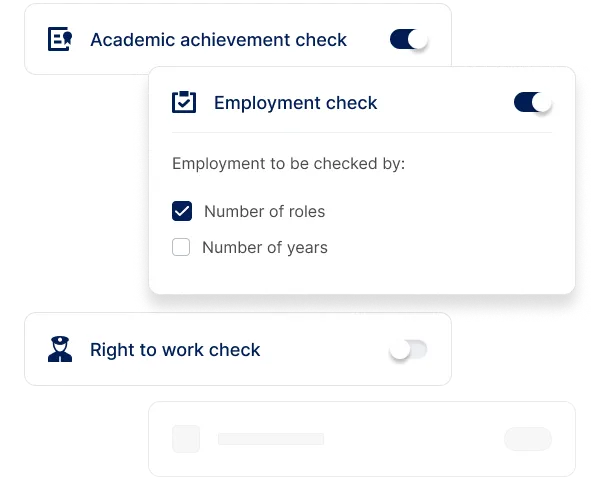

Our bankruptcy checks include:

- Ability to customize what your bankruptcy checks reveal

- Allowing you to explore whether a candidate is currently or has previously been under insolvency administration.

Trusted by the world's best workplaces

PROVEN

.png)

.png)

and Loved by reviewers

Easy

Reduce risk

No lock-in

Global checks

24/7 support

Faster time to hire

With our award-winning software, we’re the number one choice for leading brands and workplaces all over the world.

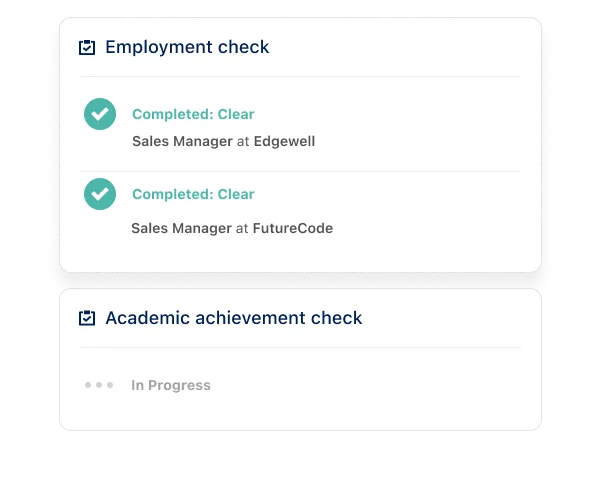

Having the right experience can be crucial to performing a role. Past financial problems can influence the hiring decisions within a company. Depending on the responsibilities of the role, many businesses will be adverse to hiring a candidate who may negatively impact their company's finances in the future.

This is not only down to their being a risk factor but also bankruptcy restrictions and regulated sectors both of which have rules in place regarding the responsibilities of an individual who has previously been made insolvent or bankrupt.

How it works

Related checks

FAQs

The answer is yes. The bankruptcy data can be used in employment decisions such as hiring, promotion, retention, and termination of employees in certain circumstances.

Some companies have been reluctant to hire people that had filed for bankruptcy. In general, if an employer feels that someone is not qualified for a job position due to their bankruptcy, then they may be able to deny them employment based on this reason. This may be particularly important when hiring for roles that include accountability for budgets and finances.

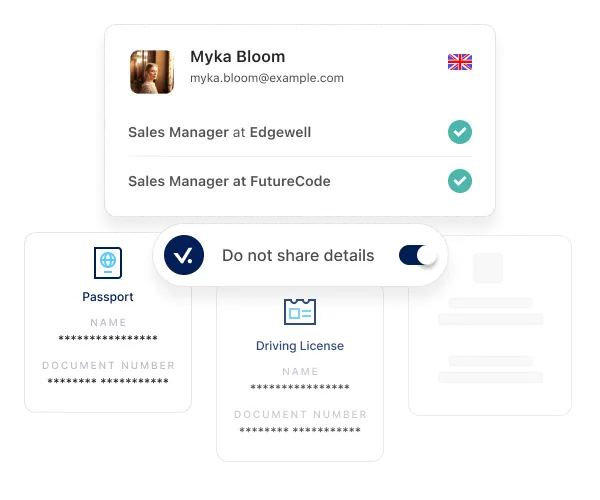

The first step in identifying whether someone has filed for bankruptcy is to look at their credit report. If there are multiple filings listed, then that person has filed for bankruptcy more than once. If there are none listed, then it can be a sign that this candidate has never filed for bankruptcy before and therefore does not have any debts against them. It can be difficult to tell if a candidate has filed for bankruptcy because some candidates list their personal information under different names or aliases on their credit reports.

Bankruptcy checks are important for all candidates / new employee hires. They are particularly important for senior candidates, and those roles dealing with finance, budgets, investments and other money-related priorities and activities.

Bankruptcy checks are important for all industries, however most important for businesses in highly regulated sectors that require significant levels of financial and operational compliance.

The answer is no. A bankruptcy check does not equal a credit check. It is just one of the many ways that people can find out about your financial status without having to go through the process of applying for one of these checks. A credit check is a type of background check that a company requests from a potential candidate to determine their creditworthiness. The use of the term "credit check" usually refers to a candidate's credit history. Credit checks can be used to assess a certain aspect of risk in employment.

Bankruptcy checking verifies whether a candidate has suffered bankruptcy.

The bankruptcy checks verify whether a candidate has previously been under insolvency administration.

Bankruptcy checks help a business to understand how a candidate manages their own finances.

Some employers ask about bankruptcy because it indicates that a person is financially stable and responsible. Bankruptcy also shows that a person has the ability to repay debts, which is an indicator of a good credit score.

The questions about bankruptcy are asked primarily to determine whether the applicant has suitably managed their financial affairs. The questions can also be used to determine if someone has been sued for bankruptcy or if they have filed for bankruptcy in the past.

A pre-employment background check can help to determine whether someone has a history of financial problems. Sometimes, candidates have a history of financial problems but are able to hide it from their potential employers.

However, by hiring a third party company to do a bankruptcy background check, you will be able to find out a candidate's financial history that includes any cases of bankruptcy.

Transform your hiring process

Request a discovery session with one of our background screening experts today.